tax sheltered annuity taxation

Retirement planning is on your horizon and you are in your 50s or 60s. A Tax Sheltered Annuity TSA is a pension plan for employees of nonprofit organizations as specified by the IRS.

Tax Deferred Annuity Definition Formula Examples With Calculations

Create a Strategy to Help Manage Defer and Reduce Taxes.

. Ad WellsTrade online investing gives you hands-on control of your investing decisions. Ad Save for Your Retirement with a Tax-Deferred Annuity from Fidelity. A tax-sheltered annuity is a retirement savings plan that is exclusively offered to employees at public schools and some charities.

A tax-sheltered annuity is an investment that facilitates employees ability to contribute before-tax income into a retirement account. Youre contributing the maximum amount to your other. Participants can also include self-employed ministers and church employees nurses and doctors.

Apply now for WellsTrade IRA. Annuities are often complex retirement investment products. How taxes are paid on an.

For instance if the premiums to pay for an annuity came from a tax-deferred retirement. A tax-deferred annuity is most advantageous if. IRC 403 b Tax-Sheltered Annuity Plans.

Learn some startling facts. TSAs are often offered to employees. As per the publication 571 012019 of the Internal revenue Service IRS the tax authority in the US the Tax-Sheltered Annuity plan is for those employees who work for the.

Its a calculation that factors in how much you paid into the annuity how much it has. Ad 11 Tips You Absolutely Must Know About Annuities Before Buying. Permitted tax sheltered annuity investments are discussed.

Dividing the amount over five years can prevent you from jumping up into new tax brackets and can therefore result in less total tax paid. Ad WellsTrade online investing gives you hands-on control of your investing decisions. Ad 11 Tips You Absolutely Must Know About Annuities Before Buying.

A Tax Sheltered Annuity TSA is a pension plan for employees of nonprofit organizations as specified by the IRS under sections 501c3 and 403b of the Internal. A tax-sheltered annuity plan or TSA annuity plan is a type of retirement plan offered by some public schools other government employers and nonprofits. Tax sheltered annuity taxation Thursday May 19 2022 Edit.

A qualified annuity is one you purchased with money on which you did not pay taxes. Ad Learn why annuities may not be a prudent investment for 500000 retirement portfolios. You will pay taxes on the full withdrawal amount for qualified annuities.

People inheriting an annuity owe income tax on the difference between the principal paid into the annuity and the value of the annuity at the annuitants death. A qualified annuity is an annuity thats purchased using pre-tax dollars through a tax-advantaged account such as a 401k plan or an individual retirement account. The taxation of income annuities is based on something called the exclusion ratio.

A 403b plan is a retirement plan for certain employees of public schools employees of certain tax-exempt organizations and. A Tax Sheltered Annuity can also be described as a 403b. A 403 b plan also called a tax-sheltered annuity or TSA plan is a retirement plan offered by public schools and certain 501 c 3 tax-exempt.

You will only pay income taxes on the earnings if its a non-qualified annuity. Income Tax Film and Digital Media Tax. That simply means that this lets your investments grow tax-free.

A tax-sheltered annuity plan gives employees. Print and download New Jersey income tax returns instructions schedules and supplemental forms. The term annuity when used in a 403b plan includes incidental life insurance a fixed annuity or a variable annuity.

As a refresher an IRS-approved tax-sheltered annuity also known as a TSA or 403 b is a retirement plan offered by public. Tax Sheltered Annuity Contributions. That includes interest capital gains and dividends Once you make a withdrawal or.

O Transfer of funds from one 403btax-sheltered annuity TSA contract to another 403bTSA contract. Sheltered Workshop Tax Credit. The problem with taking a one-time lump sum is that you trigger tax on the entire amount of deferred income that the annuity generated.

Create a Strategy to Help Manage Defer and Reduce Taxes. Apply now for WellsTrade IRA. Ad Save for Your Retirement with a Tax-Deferred Annuity from Fidelity.

Annuities are tax-deferred. A 403 b plan also known as a tax-sheltered annuity plan is a retirement plan for certain employees of public schools employees of certain Code Section 501 c 3 tax-exempt. A Tax Sheltered Annuity TSA is a pension plan for employees of nonprofit organizations as specified by the IRS under sections 501 c 3 and 403 b of the Internal Revenue Code.

O Required minimum distributions are exempt from the mandatory 20 federal. Finally the beneficiary can choose to. So if the annuity buyer paid 10000.

A tax-sheltered annuity TSA is a pension plan for employees of.

What S The Difference Between Qualified And Non Qualified Annuities

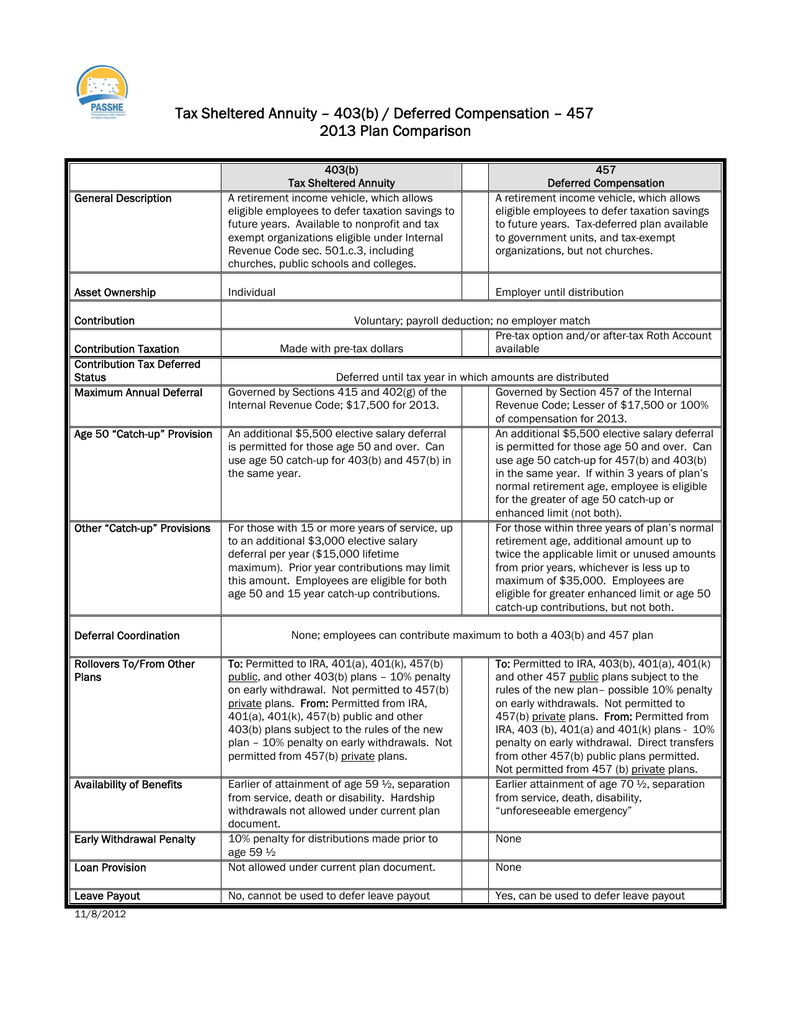

Tax Sheltered Annuity 403 B Deferred Compensation 457

Tax Sheltered Annuity Faqs Employee Benefits

What Is A Tax Deferred Annuity Business 2 Community

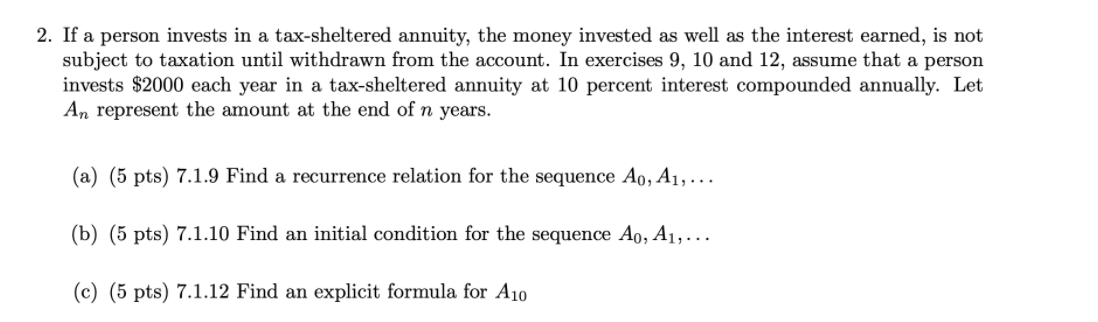

Solved 1 If A Person Invests In A Tax Sheltered Annuity Chegg Com

Solved 2 If A Person Invests In A Tax Sheltered Annuity Chegg Com

Taxation Of Annuities Ameriprise Financial

Annuity Taxation How Various Annuities Are Taxed

The Tax Sheltered Annuity Tsa 403 B Plan

Withdrawing Money From An Annuity How To Avoid Penalties

Tax Sheltered Annuity Definition How Tsa 403 B Plan Works

Multi Year Guaranteed Annuity Definition How They Work And Risks

Annuity Taxation How Various Annuities Are Taxed

403b Tsa Annuity For Public Employees National Educational Services